stock option tax calculator canada

The calculator will show your tax savings when you vary your RRSP contribution amount. The Stock Option Plan specifies the total number of shares in the option pool.

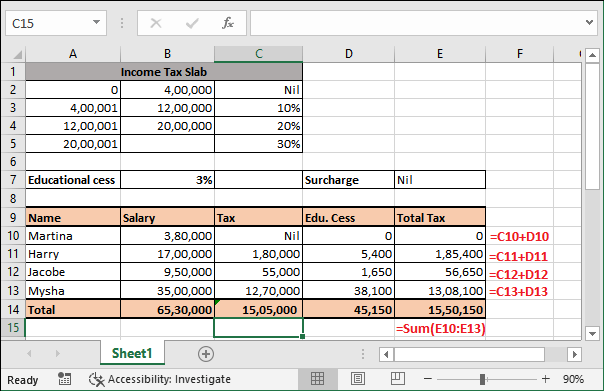

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

An option is an opportunity to buy securities at a certain price.

. Please enter your option information below to see your potential savings. Annual Capital Gains Tax Calculator 202223. You will only need to pay the greater of either your Federal Income Tax or your AMT Tax Owed so try to be as detailed and accurate as possible.

Important Note on Calculator. Thus making a stock option very tax-efficient. For more information refer to Security options deduction for the disposition of shares of a Canadian-controlled private corporation Paragraph 110 1 d1.

The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital gains inclusion rate. For example the option price is 10 for 15 shares and the employee exercised the option when 15 shares were worth 20. Annual Stock Option Grants Calculator Canadian Many companies issue annual stock option grants to their employees.

Subsection 110 1 of the Income Tax Act allows the employee to report only half of the benefit derived from exercising the employee stock option. Stock option deduction ie 50 4000 Net Taxable Employment Income 4000 Where an employees stock options qualify for the 50 deduction the stock option benefit is effectively taxed as a. Day traders make a living buying and selling stocks and because its their job capital gains taxation.

Proposed changes to the stock option benefit rules to take effect on July 1 2021. This calculator illustrates the tax benefits of exercising your stock options before IPO. Abbreviated Model_Option Exercise_v1 -.

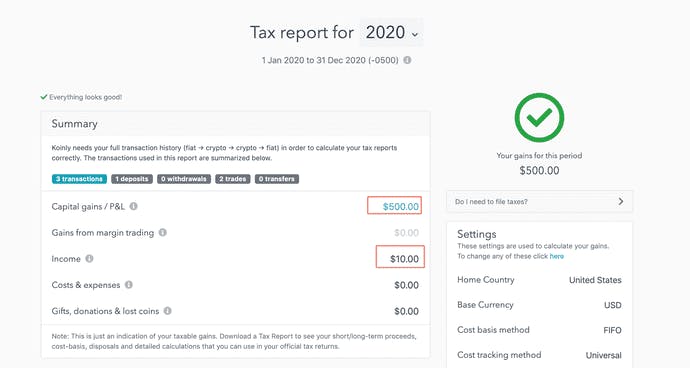

Changes to the taxation of stock option benefits are coming this summer that will affect certain Canadian employees and their employers. Calculate the Annual tax due on your Capital Gains in 202223 for Federal Provincial Capital Gains tax. The taxable benefit is the difference between the price you paid for the shares the strike price and their value on the date of exercise.

By including this 10000 on your tax return you could deduct 5000. If your options were issued and certain. The tax calculator is updated yearly once the federal government has released the years income tax rates.

Even for CCPCs the numbers arent always that clear as attributing a valuation for stock of a. However you also have a graphic design business. The employees benefit inclusion is 20 10 10.

This usually happens in late January. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Taxation at the employees marginal tax rate. Use this calculator to project how much a series of annual stock option grants could be worth to you.

Under the employee stock option rules in the Income Tax Act employees who exercise stock options must pay tax on the difference between the value of the stock and the exercise price paid. When you buy a security and sell it at a profit you realize a capital gain. How much are your stock options worth.

However you can deduct 100 of your trading losses against other sources of income. Abbreviated Model_Option Exercise_v1 - Pagos. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in.

Locate current stock prices by entering the ticker symbol. Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again. 2021 free Canada income tax calculator to quickly estimate your provincial taxes.

If you decide to exercise your option and buy the securities at less than the fair market value FMV you will have a taxable benefit received through employment. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. Please enter your income deductions gains dividends and taxes paid to.

While these changes have not yet been enacted into law at the time of writing it is expected that they will. The Stock Option Plan was approved by the stockholders of the grantor within 12 months before or after the date of adoption of the Plan. 50 of the value of any capital gains are taxable.

Select Province and enter your Capital Gains. If you buy a share for 1000 and sell it for 2000 you. This permalink creates a unique url for this online calculator with your saved information.

If you have any questions on how to calculate the alternative minimum tax or any of. This benefit should be reported on the T4 slip issued by your employer. While many startups in Canada will qualify as a CCPC keep in mind that there are different rules for non-CCPCs and public companies which would have a separate set of tax implications when issuing stock options.

This Tax Insights discusses the new employee stock option rules and answers some common questions on the topic. This capital gains tax reduction doesnt apply for day traders who pay 100 tax on income from capital gains. The securities under the option agreement may be shares of a corporation or units of a mutual fund trust.

Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions. Updated for tax year 2021. The options were granted within.

Deducting Losses Unfortunately as a day trader you cannot utilise the 50 capital gains inclusion rate on your profits. For the average Canadian the taxable capital gain is determined by multiplying the capital gain amount with the years inclusion rate. Youll pay capital gains tax in Canada on the difference when you buy a share and then sell it for a higher price.

Stock Option Deduction Stock option benefit as previously calculated 8000 Less. Receiving a stream of stock options over a period of years can be an incredible benefit. Currently the rate is 50.

When you exercise your employee stock options a taxable benefit will be calculated. Considering certain conditions are met you can claim a deduction equal to 50 of the stock benefit. You will face tax on the 10000 benefit this is where the idea of stock options should be of interest to you.

You can calculate your Annual take home pay based of your Annual. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2021. At a 30 tax rate shell pay 600 of tax on the gain.

So lets say you rack up 25000 in trading losses this tax year. Your income tax rate bracket is determined by your net income which is your gross income less any contributions to registered investment accounts. The taxable benefit is the difference between the fair market value FMV of the shares or units when the employee acquired them and the amount paid or to be paid for them including.

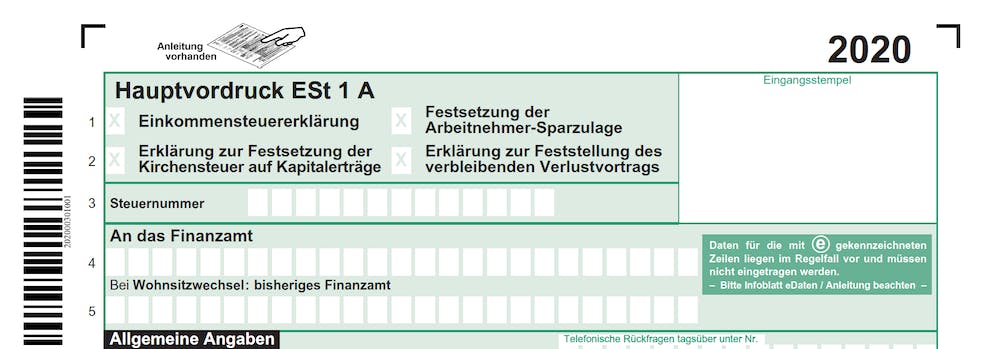

Germany Crypto Tax Guide 2022 Koinly

Bc Income Tax Calculator Wowa Ca

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Income Tax Calculating Formula In Excel Javatpoint

Calculator Logo Tax Logo Bookkeeping Logo Cpa Logo Etsy Business Logo Premade Logo Design Brand Fonts

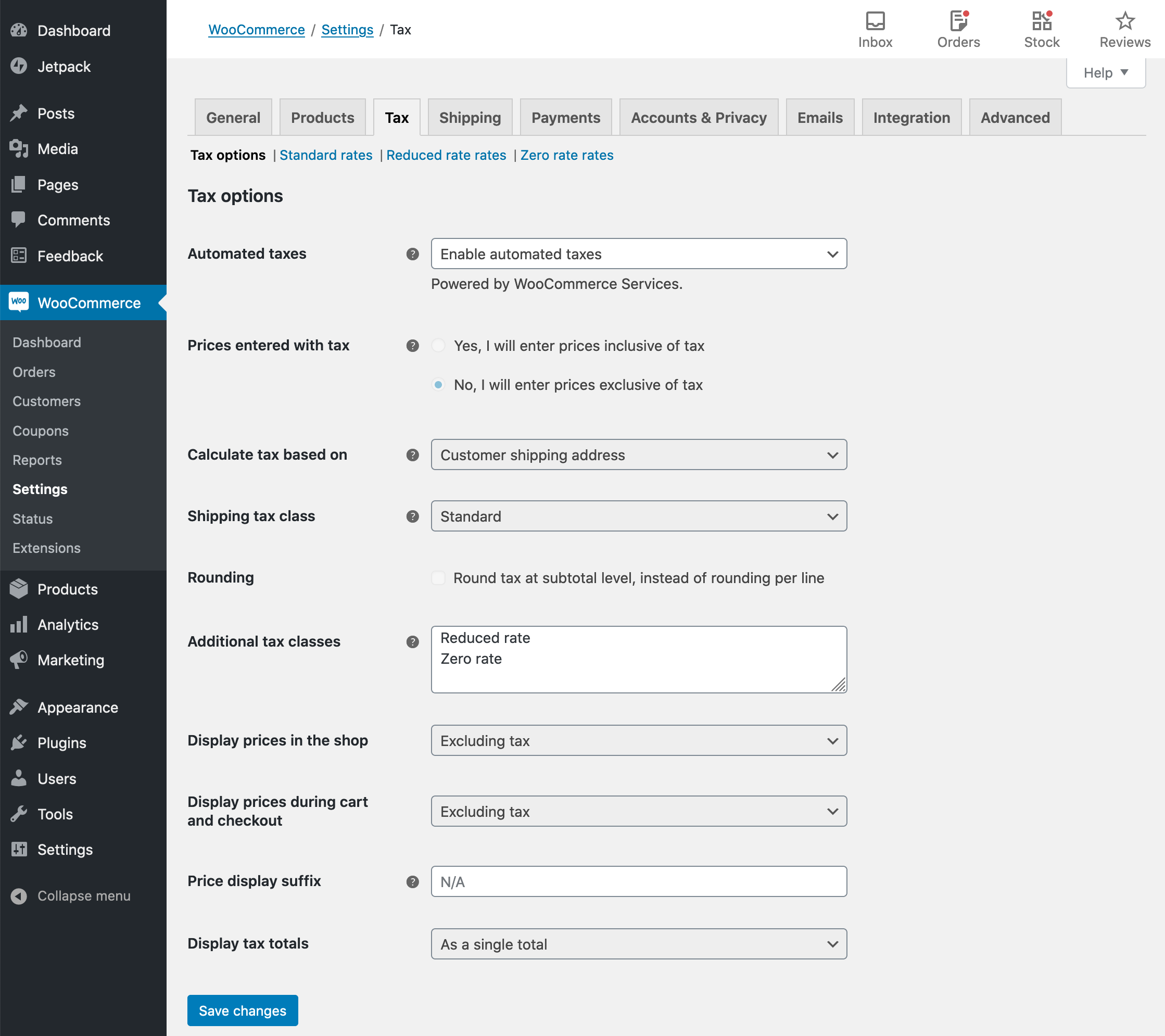

Woocommerce Tax Guide Woocommerce

Germany Crypto Tax Guide 2022 Koinly

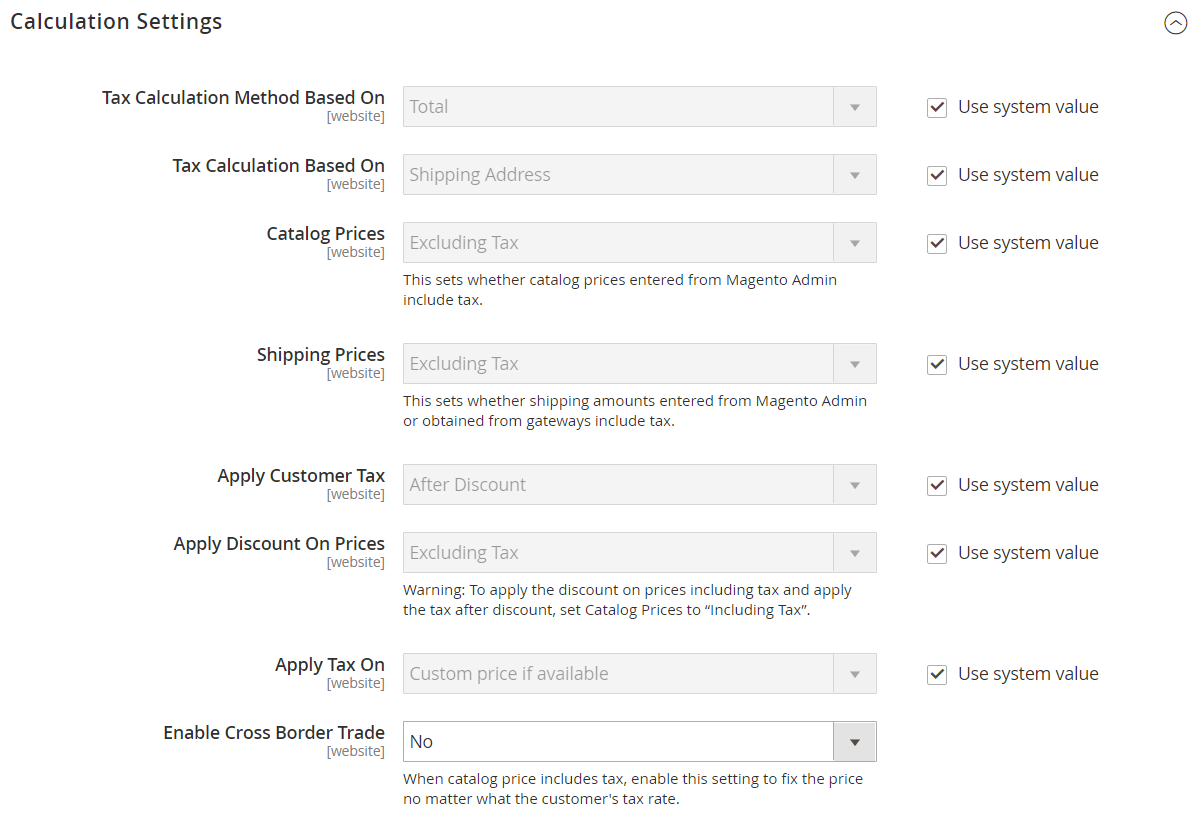

General Tax Settings Adobe Commerce 2 4 User Guide

How To Determine The Tax Deduction Value Of Donated Items Tax Deductions Deduction Irs Taxes

What Is The Formula To Calculate Income Tax

Germany Crypto Tax Guide 2022 Koinly

Income Tax Calculator Fy 2022 23 Calculate New And Old Regime Tax

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Germany Crypto Tax Guide 2022 Koinly

Income Tax Calculating Formula In Excel Javatpoint

Option Greeks Calculator Live Excel Sheet Excel Options Trading Strategies Stock Options Trading